The Elusive 100% LTV Fix and Flip Loan

If you’re cash strapped and in escrow to purchase your next fixer-upper, you might be searching online for a hard money lender to give you the...

6 min read

Ted Spradlin

:

Jan 21, 2024 12:00:24 PM

Ted Spradlin

:

Jan 21, 2024 12:00:24 PM

If you've always wanted to flip houses and just found a great deal on a fixer-upper that would make a perfect flip, your next step is to find the money to make it happen. But as your first flip, you’ll soon discover that finding the money may be harder than you expected.

This article is intended to make the money part of the equation a little easier to understand, arming you as a first-time house flipper with key information about private money loans.

You’ll come away knowing how fix and flip private lending works and what you need to provide to get approved, funded, and started on your first fix and flip project.

A hard money loan is an equity-based mortgage provided by an individual or hard money lender, secured by the value of the hard asset (real estate).

A private money loan, on the other hand, builds upon the equity-based nature of a hard money loan, but additionally factors the borrower’s background, personal credit, property cash-flow (if leased), use of loan proceeds, and much more, which we’ll discuss in greater detail below.

Most fix and flip loans are private money loans made by mortgage lenders rather than hard money loans provided by private individuals or trust deed investors.

No, banks don’t provide fix and flip loans, at least not directly to house flippers and rehabbers.

Banks do, however, provide credit lines and credit facilities to private money mortgage lenders and mortgage funds, which then issue fix and flip loans to real estate investors.

As a first-time house flipper, you can’t ask your bank to finance your first project. Banks don’t participate in the retail fix and flip financing market — they're the wholesale capital providers (or warehouse lenders) to the private money lenders who serve the retail borrowers.

Private money lenders and mortgage funds must underwrite their loans to comply with the loan covenants of the bank warehouse credit facilities that fund them.

This means that as a first-time house flipper, you'll be required to provide the following personal and financial information to the underwriter for loan approval.

The lender will run your personal credit report to make sure that you have at least a 650 FICO score. Some private lenders require first-time house flippers to have a 700 FICO score, since a 650 usually signals maxed out revolving credit accounts.

Credit reports reveal active and previous debt, bankruptcies and foreclosures on conventional mortgages during the past seven years, some judgments, delinquent child support, and some but not all income tax liens.

Background checks uncover information not found on credit reports, including:

Photo ID

Some background checks will have the most recent driver’s license photo, which helps protect against fraud.

Private lenders will request the most recent 3-6 months of bank statements to check for liquidity and ask borrowers to source any large deposits to comply with anti-money laundering laws.

The bank statements prove to the lenders that the borrower has enough money to cover the down payment, closing costs, and post-close liquidity requirements to service 6-12 months of payments along with property taxes and utilities.

For a detailed breakdown of the cash and liquidity requirements, see our article How Much Money Do You Need to Flip a House?

As a first-time house flipper, prepare to provide your most recent income statements, including a paystub if you’re a W2 employee or YTD P&L if you’re self-employed. Additionally, private lenders will want to see your most recent year’s personal and business tax returns.

It’s common for a general contractor (GC) or a commercial construction project manager (PM) to flip a residential property. They’ve been doing the work professionally for several years — often making other people a lot of money — and feel it’s their time to get paid for their knowledge and expertise.

In these cases, a GC or PM will submit their professional resume along with their bank statements, income statements and tax returns.

If you're the GC on the flip or are hiring a GC, you'll need to submit a GC application plus a copy of the license and insurance coverage. Private lenders will run a background check on the GC to make sure they meet the requirements.

As a first-time house flipper, you may be short on the cash required to qualify for the private money loan. In this case, you may bring in a friend or family member as your equity partner in the deal.

You may have a profit-sharing agreement with the equity partner, where they provide some or all of the capital for the down payment, closing costs, and post-close liquidity requirements while you manage the rehab project. You’ll split the profits from the sale according to your agreement.

Private money lenders require the same personal and financial information from your equity partner as they do for you. This includes:

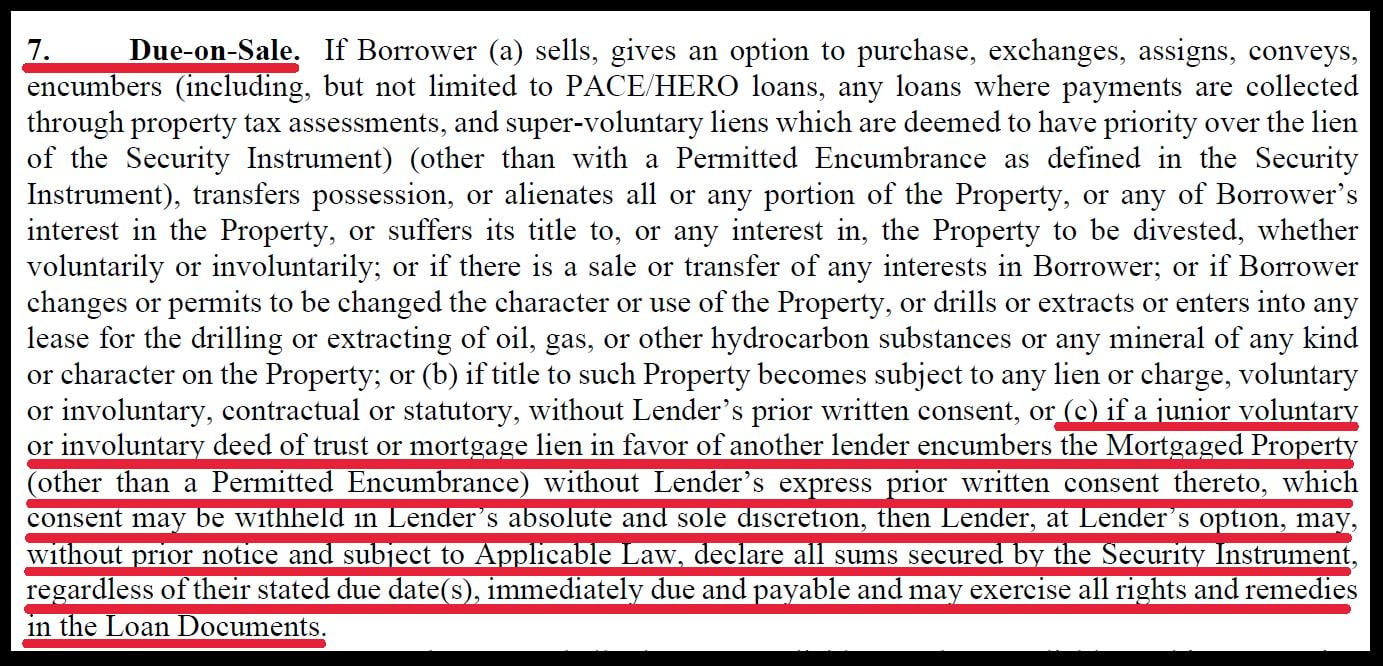

Some equity partners want to secure their interest in the property to ensure they get paid in full when it sells. However, the promissory note language may prohibit voluntary junior liens, like a second mortgage from an equity partner.

The underlined language in the image below is very common.

If your equity partner insists on recording a junior lien, first check with your private lender to see if it's possible. Some lenders allow it, while many lenders prohibit second liens from being recorded.

While we’re on the topic of equity partners who may or may not want to record a second lien to secure their interest in the property, we need to discuss gap funding.

Gap funding is a high-leverage hard money or private money second mortgage on a fix and flip project that provides the down payment, closing costs, and sometimes the rehab funds. Gap funding is debt whereas your equity partner has an equity stake.

Many first-time house flippers, often with no money or experience, learn about gap funding and browse online for a gap lender to help them acquire a property.

Looking for gap funding as a first-time house flipper is a waste of time. In fact, it’s even a waste of time for a house flipper who completes five or six projects each year. The people who get gap funding loans are big-time players with companies that flip 25+ homes annually — or they have a house-flipping TV show.

Private money lenders will never give a first-time house flipper 100% financing to cover the purchase, closing costs, and rehab all in one loan.

Many first-time investors spend a lot of time looking for the elusive 100% financing program. But just like looking for a gap funding second mortgage, it’s a waste of time.

The following private money fix and flip loan terms are what you can expect for your first project:

It’s possible that a private lender will do 75% LTV or even 80% LTV on the purchase money portion of the loan. This can happen when the borrower has significant liquidity AND experience as a GC, PM, or owner of many rental properties.

I mentioned above in the bank statement section that you would need post-close liquidity. Or, if you have an equity partner, combined you would need sufficient cash on hand to cover 6-12 months of mortgage payments, plus utilities and property taxes.

Private money fix and flip lenders don't allow loan payments to be deferred and added onto the balance of the loan. It’s not even a possibility for a first-time house flipper (many first-time rehabbers have asked!)

Summary

As a new house flipper using private money financing for your first deal, you’ll want to start with securing your down payment funds — either from your own accounts or from an equity partner who will share in the profits from the project. Once you have enough cash, make sure your financial documents are organized and ready to provide to the underwriter for quick approval.

First-time house flippers need to understand that private money loans are going to limit them to 70-80% LTV on the purchase portion of the loan. Private lenders will often go 100% LTC on the rehab financing. There aren’t any zero down payment options for cash-strapped first-time flippers. Private lenders will only lend to rehabbers (and their equity partners) who have the cash for the down payment and closing costs, along with post-close cash to service the debt if the project extends the full 12 months.

If you’re cash strapped and in escrow to purchase your next fixer-upper, you might be searching online for a hard money lender to give you the...

If you’re a house flipper already approved for a hard money first mortgage, but need a second mortgage to cover down payment and closing costs,...

If you have a seller willing to carry a note, funding your fix and flip with seller financing instead of a hard money loan is a better and cheaper...