First Capital Trust Deeds (FCTD) has been originating cannabis hard money loans on licensed marijuana real estate since 2015. During this time, FCTD has spoken to hundreds of potential borrowers about their business and financing needs, worked through simple to complicated financing scenarios, and secured cannabis real estate financing to keep many businesses moving forward.

This article will cover what I’ve learned originating loans for licensed cannabis properties over the years – and what I think is most important to know about this sector. The internet has some information about cannabis lending, but based on all the financing inquiries FCTD has received over the years, this information is incomplete. My goal is to provide the most comprehensive facts about cannabis mortgages to help owner operators and investors make better informed decisions.

Let’s dive into the details.

Cannabis Mortgage Lending Sources

Licensed cannabis properties can be financed by the three different types of lenders:

- Hard Money and Private Money Lenders

- State-Chartered Banks

- State-Chartered Credit Unions

Hard Money and Private Money Lenders

Since legalization began, hard money and private money lenders have been the primary source of real estate financing for cannabis properties. (For simplicity, I’m going to call it “hard money” rather than “private money” lending. They’re different, but most people call it “hard money lending.”)

Hard money lenders have provided the debt to build, acquire, renovate, and maintain long-term cannabis operations. These lenders fall into four of the five hard money lender types:

- Individual Trust Deed Investors

- Real Estate Investors with a Lending Division

- Family Offices

- Mortgage Funds

I didn’t include the fifth hard money lender type, conduit lenders, which originate and sell loans mostly to institutional investors on Wall Street or pension fund managers who are regulated by the SEC or FINRA. Cannabis isn’t legal at the federal level, so conduit lenders are unable to finance a cannabis property and sell the loan to their investors on the secondary market.

Individual Trust Deed Investors

An individual trust deed investor is usually a high-net-worth individual with a background in real estate, finance, or the legal profession. They’re experienced in investing in hard money loans and often work through hard money mortgage brokers like FCTD, which provides them with a steady flow of lending opportunities to keep their money working.

Marijuana business owners may also know high-net-worth individuals who can fund the real estate used for operations. I’ve seen several situations where an individual secured their investment in the cannabis business as a mortgage against the property, receiving monthly payments similar to a dividend or distribution from the business.

Real Estate Investors with a Lending Division

If you’re not in real estate lending, you might be surprised by how many real estate investment companies have a lending division that funds hard money loans for other real estate investors. These companies are composed of a few investors, usually a close group of high-net-worth individuals featuring a General Partner (GP) who manages investments for the Limited Partners (LPs). These real estate offices will lend on cannabis properties if they like the borrower and the property. If the loan defaults, they would be comfortable taking the property through foreclosure to return their capital.

Family Offices

Family offices have multiple generations of family members managing real estate holdings accumulated over decades of investment. Similar to real estate offices, family offices lend money to other real estate investors. FCTD works with a few family offices whose lending division has surpassed $150 million. They know commercial real estate inside and out and will lend against a cannabis property if the loan makes sense.

Mortgage Funds

Mortgage funds are lenders comprised of several high-net-worth individuals, or LPs, investing into a debt fund managed by a fund manager, or GP. Mortgage funds are usually licensed mortgage lenders originating and servicing hard money loans. FCTD works with a few mortgage funds that have provided long-term cannabis real estate financing secured by properties in the western United States.

State-Chartered Banks

There are some state-chartered banks that will make loans against licensed cannabis properties. They tend to stay away from cultivation, preferring real estate used for retail, research or distribution.

Most people in the cannabis industry know the one or two banks in their state that could potentially finance their building. State-chartered banks are an excellent exit strategy to pay off a hard money loan since they offer long-term financing, usually in the form of a 5-year fixed rate loan amortized over 25 years.

State-Chartered Credit Unions

State-chartered credit unions are similar to state-chartered banks. They also tend to avoid cultivation, sticking with mortgages on retail, research and distribution properties. Many cannabis companies have a depository relationship at their state-chartered credit unions.

FCTD worked with a borrower who had had a credit union loan for their cannabis cultivation facility. They were put in a tight spot when a neighbor, upset that the facility was replacing a former horse property, informed the credit union that the owner was starting cultivation – which went against the covenants of the loan. The credit union accelerated the loan, and FCTD was able to help them pay it off through a hard money loan.

Cannabis Real Estate Financing – Eligible Property Types

Hard money lenders will lend against the following licensed cannabis property types:

- Retail

- Farm

- Industrial – Warehouse Growing, Research and Distribution

Retail – Mortgages for Cannabis Retail Properties

Dispensaries are the most common retail property type in cannabis real estate. Retail buildings can be a free-standing property or a retail strip mall where a dispensary is one of many tenants.

Farm – Outdoor Cannabis Grow Facilities

FCTD has funded both farm properties where the plants grow outside and farms where the plants grow inside an acre of greenhouses.

How Hard Money Lenders Value Cannabis Greenhouses

Hard money lenders don’t assign any real estate value to greenhouses used to grow cannabis because most greenhouses can be disassembled and reinstalled on another property. Instead, they’re considered personal property. I’ve spoken to many cannabis growers who spent a lot of money on greenhouses and would like to borrow money against them. However, since they’re not considered real property, they can’t be collateral for the hard money loan.

A hard money lender can make a smaller loan against the greenhouses, securing the debt with a UCC-1 Statement.

Industrial Buildings for Cannabis Use

Cannabis businesses can lease or own lots of industrial buildings. FCTD has worked with numerous companies to obtain real estate financing on their properties.

Warehouse – Indoor Cannabis Grow Facilities

Hard money lenders will finance indoor cannabis growing facilities, which banks and credit unions avoid. FCTD has originated construction loans and purchase money financing, as well as refinanced properties into long-term hard money debt for indoor growers.

Lenders will order a property appraisal, do a site visit to meet the borrower(s) and see the operation, and possibly bring in a hydroponics expert to inspect and ensure the systems are set up and running correctly. The last thing a lender wants is to finance a property with faulty indoor irrigation systems that could lead to major water damage – a very costly remediation.

Warehouse – Cannabis Distribution Center

Hard money lenders, and state-chartered banks and credit unions, can finance distribution centers. State-chartered banks and credit unions will fund a loan on distribution facilities because they’re not used in cultivation.

Warehouse – Cannabis Research

Banks, credit unions and hard money lenders can finance research and development facilities. They may not finance every loan presented to them – but it’s in their scope to finance these properties.

Financing Options for Cannabis Landlords

I get many calls from commercial real estate brokers who have listings where one or more of the tenants are in the cannabis business. They want to know what financing options are available to a potential buyer.

As I’ve written above, hard money lenders and state-chartered banks and credit unions can help an investor acquire a building. Banks and credit unions will use market rents rather than inflated cannabis rents – which have been 50-300% higher than a regular tenant like a plumbing supply business. Market rents bring the loan amount down to a level that if the cannabis tenant vacated the space, a non-cannabis tenant could move in with rents that would cover the debt service coverage ratios.

Cannabis Mortgage Lending - Pricing, Closing Costs, Terms, Etc.

Below is the range of pricing for hard money loans and an example of pricing from a state-chartered bank for a landlord loan.

Pricing Range for Hard Money Cannabis Loans

| Loan Amount: | $250,000 to $10 million |

| Interest Rate: | 10.00%+ |

| Term: | 12 to 240 months |

| Points / Origination: | 3 to 5 points |

| Prepayment Penalty: | 3 to 60 months |

| Appraisal: | $2,000 to $3,000 |

| Environmental: | $2,000 to $3,000 |

| Site Visit: | $1,000 to $4,000 |

| Legal Review: | $1,000 to $5,000 |

| Loan-To-Value (LTV) | 50 to 55% LTV* |

| *65% LTV in some cases |

FCTD has originated several 15-year fully amortizing loans with a five-year prepayment penalty and an adjustable interest rate for cultivation properties. The reason for the longer, 15-year term is that there isn’t any institutional financing for cultivation. If a borrower took out a three-year loan, they would need to refinance into another hard money loan within just a few short years, again incurring tens of thousands of dollars in loan fees. Therefore, the longer-term loans are a better solution for the borrower.

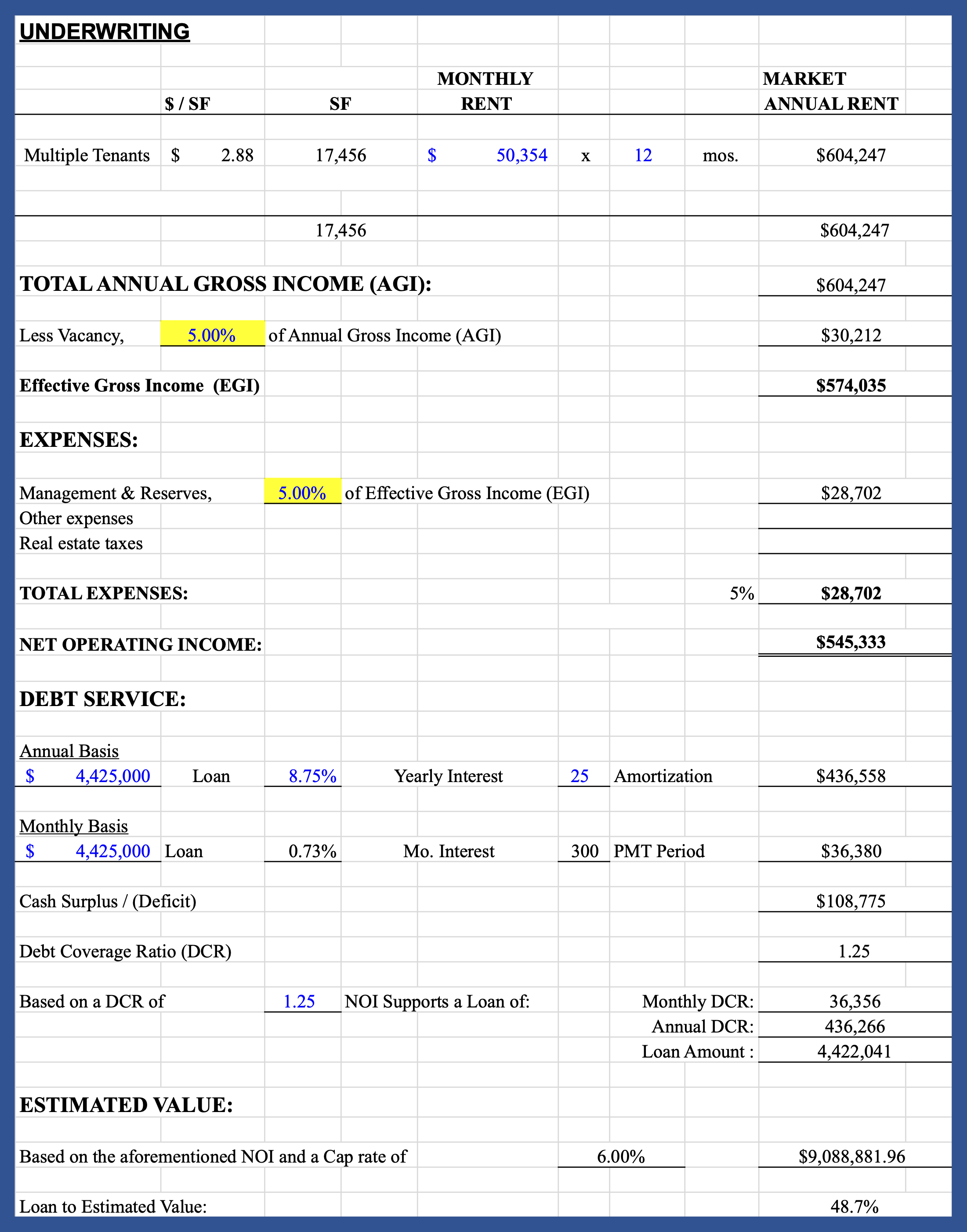

Bank Pricing for Cannabis Landlord Loan

Below is an actual example from a state-chartered bank for a landlord property, which a real estate agent requested for potential buyers. The bank priced their loans a prime + 1.00% to 1.25%. At the time of this quote, prime was at 7.75%, so the note rate was 8.75%. The bank loan example below was for a 25-year fully amortizing loan with a five-year fixed interest rate, which is standard across bank and credit union offerings.

Remember, each loan has its own set of unique characteristics that impact pricing. There isn’t a one-size-fits-all pricing model for hard money cannabis loans. Banks and credit unions set their own guidelines and pricing models, which vary from lender to lender.

10 Problems in Cannabis Mortgage Financing

I’ve spoken to several hundred potential cannabis real estate borrowers over the years and come away with a list of the top 10 problems that prevent them from obtaining hard money or institutional financing against their properties.

Here is a quick list of the top ten problems:

- Lenders have seen the loan scenario several times

- Inflated appraisals

- CMBS lender calls or accelerates the loan

- Limited liquidity

- Inflated crop value

- Illegal grow houses

- Unrealistic expectations

- Partner buyouts

- Thinking federal legalization is imminent

- Massive warehouse in rural location

I go into greater detail on each item above in this blog post, 10 Problems in Cannabis Mortgage Financing.

We Do Not Provide These Cannabis Financing Programs

FCTD originates hard money, bank, and credit union mortgages against licensed cannabis properties. We don’t work with these other types of commonly requested financing programs:

- Cannabis Equipment Financing

- Cannabis Inventory Financing

- Cannabis Invoice Factoring

- Cannabis Line of Credit

- Cannabis Deposit Relationship

We have no expertise on these types of financing. What we do know is real estate financing, and we stick to it.

Conclusion

The cannabis real estate industry has long benefited from access to non-traditional financing. Hard money lenders, along with state-chartered banks and credit unions sustain investment in licensed cannabis-related properties — from retail spaces and farms, to industrial buildings. At FCTD, we have many years of experience brokering loans in this sector. We understand what is and isn’t fundable, and through our lending partners, offer a variety of options to those seeking financing.

More about Cannabis Hard Money Loans

3 min read

Financing Options for California Cannabis Landlords — 2024

Mar 27, 2017 by Ted Spradlin