FCTD PRICING GUIDE

Table of Contents

Introduction

Hard money and private money loans operate differently than traditional loans – and pricing is no exception. As with any financial tool, it’s important to understand what variables impact the bottom line of a hard money loan. Our guide provides everything you need to better grasp the pricing nuances of private money financing. I’ll cover the following topics:

Fundamental Principles of Hard Money and Private Money Loans that Impact Price

Before we dig in, let’s discuss the fundamentals of hard money, and the terms we use.

What’s the Difference Between Hard Money and Private Money Loans?

When people talk about hard money and private money loans, they’re referring essentially to the same thing – a short-term, asset-based real estate loan made by a private lender, rather than a bank or traditional mortgage lender, which offer 30-year fixed rate loans.

Technically, a hard money loan is a bridge loan secured by a hard asset – real estate. Hard money lenders traditionally make loans based on the protective equity in the property without considering the borrower’s credit rating, track record, or liquidity.

Private money loans, on the other hand, build upon the protective equity between the loan balance and real estate value, accounting for the borrower’s credit, liquidity, experience, plan for the property, and exit strategy of how the loan will be repaid through property sale or refinance.

Most real estate agents, conventional mortgage lenders, and borrowers call it “hard money,” whereas people in the hard money lending business call it “private money,” since we conduct more due diligence when underwriting loans.

I use hard money and private money interchangeably on the website.

What are the Different Types of Hard Money Loans?

At FCTD, we do eight types of hard money loans:

- Bridge Loans

- Commercial Loans

- Construction Loans

- Cross-Collateral Blanket Loans

- Fix and Flip Loans

- Owner-Occupied Bridge Loans

- Rental Property Loans

- Second Mortgages

Each of these loan programs has a pricing structure based on its unique loan characteristics and the diverse funding sources.

What are the Different Types of Private Money Lenders?

As mortgage brokers, we work with five types of funding sources for private money loans:

- Individual Trust Deed Investors

- Real Estate Investment Funds Lending Money

- Family Offices

- Conduit Lenders

- Mortgage Funds/Debt Funds

These five funding sources all come with their own pricing structure.

Some lenders, like individual trust deed investors, who often prefer safer, lower-leverage bridge loans, might not charge upfront points, and will also take the yield on the note.

Others, like conduit lenders, who specialize in fix-and-flip loans that they sell to secondary market investors (like pension managers and hedge funds), charge upfront fees since the yield will be taken by the loan buyer.

Interest rates

In 2023, hard money interest rates ranged from 10.00%-15.00%. The lower leverage the loan, the lower the interest rates. First trust deeds will have lower rates than second trust deeds.

Fees

The fees you’ll pay depend on the circumstances of your loan.

- Origination fees or points – these are charged as a percentage of the loan amount. For example, a $100,000 loan with a three points origination fee would equal $3,000.

- 3rd party fees – you may need the services of an appraiser, attorney, site inspector or more.

- Loan processing fees – this includes costs for underwriting, doc prep, processing, a credit report, and more.

- Interest reserve – these funds are held in a sub-escrow account to make a specified number of payments, usually for bridge-to-sell loans for newly constructed homes.

- Closing costs – title, escrow and recording are all part of your closing costs.

There’s lots more to learn about interest rates, fees and closing costs. We also have a specific section on fees related to second mortgages.

With the basics covered, let’s discuss the drivers of hard money and private money loan pricing.

The most important factors that increase the price of hard money loans are:

- Borrower Inexperience or Over-Indebtedness

- Property Condition

- Leverage – Loan-To-Value (LTV) and Loan-to-Cost (LTC)

- Funding Source – 5 Different Types of Funding Sources

- Federal Reserve Interest Rate Hikes

Borrower Inexperience or Over-Indebtedness

The weaker the borrower on paper, the higher the pricing for a private money loan – including a higher interest rate and upfront points. Signs of borrower weakness include:

- Borrower Inexperience

Borrowers with less experience will often have a higher cost of funds – without a track record of successful projects, they’re a riskier bet. - Low Credit Scores (650 and below)

A 650 FICO score usually indicates on-time payments, but most revolving accounts (credit cards) are maxed out or close to it. - Recent Bankruptcy and Foreclosure Activity

Multiple bankruptcy filings and foreclosure activity limits the number of hard money lenders willing to consider the loan. History has a way of repeating itself and most lenders don’t want to deal with likely legal action. However, there are some lenders who are open to working with those who’ve experienced bankruptcy and foreclosure. They charge a lot more for their money in anticipation of possible legal work down the road.

Property Condition

If the property is in rough shape – like being boarded up for a decade – the project would be expected to take longer due to unexpected repairs. This poses a higher risk of default to the hard money lender.

Leverage – Loan-To-Value (LTV) and Loan-to-Cost (LTC)

Higher LTV (75%+) and LTC (80-85%) loans cost more than lower-leverage loans at 50% LTV/LTC. The reason is less protective equity in high-leverage loans.

Availability of Capital – 5 Different Types of Funding Sources

If a borrower has several blemishes on their credit and background, they’ll be limited to local lenders with higher pricing. If they had a clean track record, they could obtain financing with one of the nationwide private lenders.

For example, FCTD secured a 10-house construction loan for a home builder who took on more projects than they could handle. The builder was unwinding and liquidating the other projects, which had gone into default. As a result, the nationwide private money construction lenders, (which had a lower cost of capital) would pass (3 points at 8.75%). We had to go with a local lender (5 points at 11.00%) to finance the construction.

Nationwide lenders usually have better pricing than local lenders.

Federal Reserve Interest Rate Hikes

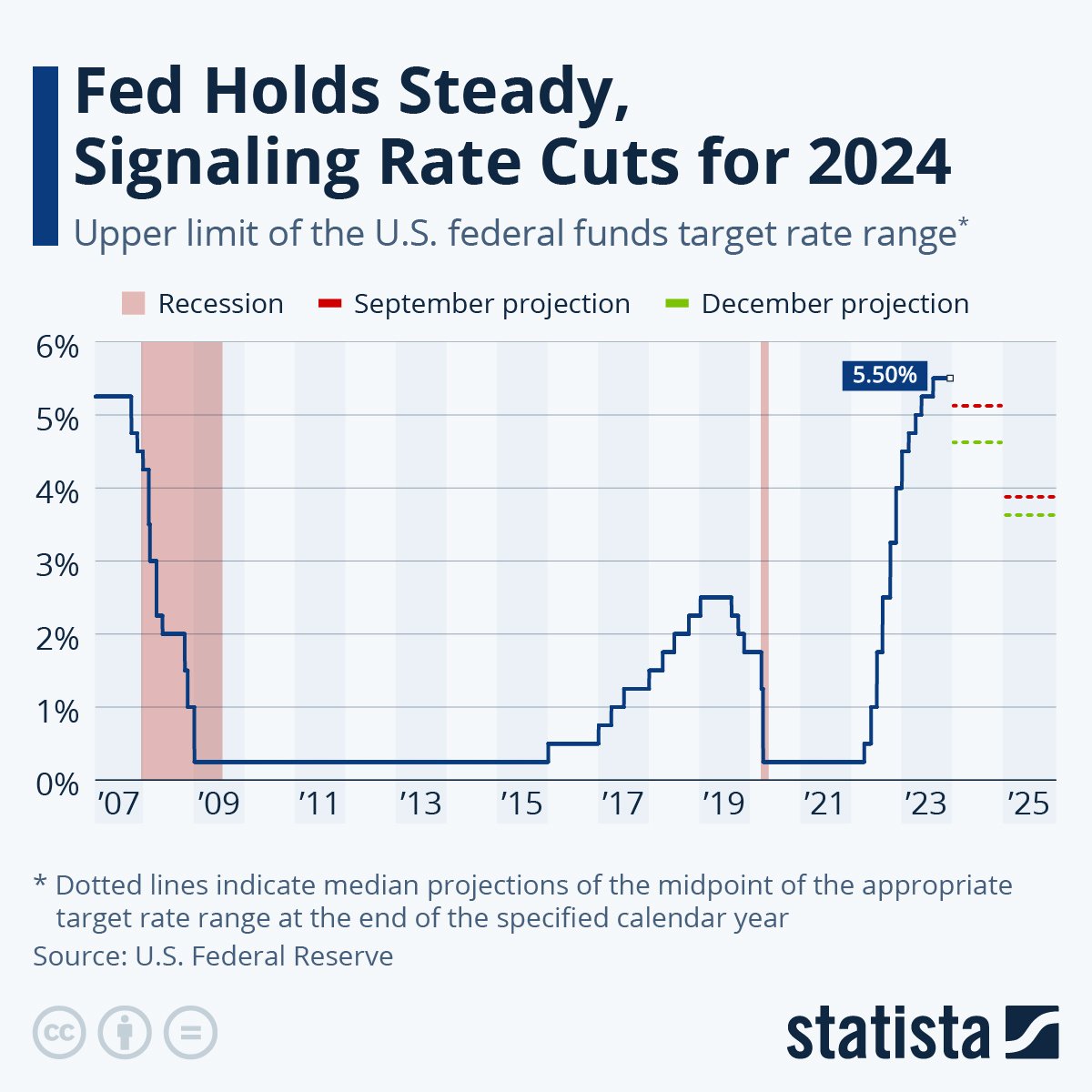

When the Fed started raising interest rates in March 2022, jumping from 0.25% to 5.50% in 16 months for the Federal Funds Rate, hard money and private money lenders followed along and raised their interest rates.

The most important factors that drive hard money and private money loans down include:

- Borrower Experience, Track Record, and Liquidity

- Geographic Location

- Leverage – LTV & LTC

- Availability of Capital

Borrower Experience and Track Record

The more projects you’ve completed, the less risky you become – and you’ll be rewarded with lower pricing on the upfront points and interest rate for your hard money loan.

FCTD has originated loans for high-earning professionals (doctors, dentists, attorneys, real estate agents, and even other mortgage brokers) who also develop and invest in real estate. The income from their day job, along with their accumulated savings and liquidity, improves their cost of funds for a private money loan.

You’re going to get better hard money loan pricing if your collateral is an ocean view, single-family home in Orange County than an undeveloped parcel of land in Barstow.

Lower Leverage – LTV & LTC

The lower your LTV and LTC, the better the pricing. In 2020, when the Fed lowered the federal funds rate to 0.25%, FCTD, through a few of our family offices and conduit lenders, originated several low-leverage (40-50% LTV) private money bridge loans on completed spec homes at one point origination with a 6.50% rate. It was bank bridge loan pricing without the bank underwriting process – closing in one week rather than one month.

Availability of Capital

Pricing in California is lower than Oregon and Washington because it’s a much larger economy with many more private lenders competing for the loans. The Portland and Seattle-based lenders have a higher pricing structure than the lenders based in Los Angeles or Orange County. More money means lower pricing – less money means higher pricing.

Lender pricing depends on the source of their capital. I find that the lenders with a higher pricing model have a higher cost of capital.

For instance, FCTD works with a few debt funds in the Pacific Northwest that originate loans to be held in their loan portfolio. A $100 million fund is comprised of several passive individual investors, managed by the fund manager (lender) who makes all loan decisions and runs the day-to-day operations.

The fund manager may have a 10.00% target return they give to their investors. In that case, they’ll charge a 12.00% note rate on all of their loans, since there is always money sitting idly between payoffs coming in and new loans going out.

Additionally, debt fund lenders in the Northwest usually charge between 2-4% points upfront on new loans. This pays the fund manager and their staff.

What I’ve found is that these lenders, with their knowledge of local markets and submarkets, will take on tougher, riskier loans in Oregon, Washington, and Idaho that lenders from California would pass on. They charge more for their money, but have a track record of delivering for real estate investors who need private money financing.

As I mentioned above, lenders in California tend to be less expensive than lenders in Oregon and Washington. The source and structure of lender capital can result in lower priced hard money mortgages.

Individual Trust Deed Investors

Hard money mortgage brokers like FCTD have a network of high-net-worth individuals who fund our bridge loans and second mortgages. The majority prefer low-leverage and lower yielding loans because they don’t want the headaches of having to deal with default.

Low-leverage first mortgage bridge loans placed with individual trust deed investors may have a pricing structure of two points at 10.00%.

Some individual trust deed investors want higher yields on their money and will fund second mortgages. These loans may cost two to three points at 12.00% to 13.00%.

Fix and Flip Conduit Lenders

The high-leverage (80%+ LTV purchase/100% LTC rehab) fix and flip lending market is supported by pension and hedge funds (the secondary market). Private fix and flip mortgage lenders are simply pass-throughs (conduits) that underwrite and originate loans to sell to secondary market investors.

Fix and flip lending is highly competitive, with borrowers always looking to save a little money here and there. Thus, lenders have to offer terms that keep the machine churning out loans.

Conduit lenders make their money on the upfront fees (often a 0.50% to 2.00% origination fee) and receive a small portion of the monthly payment stream.

For example:

A borrower may pay a 10.99% note rate on a fix and flip loan. After selling the loan into the secondary market for 10.50%, a conduit lender will receive a 0.49% strip of the monthly payments from that loan – plus all the other loans from the past year or two that are still on the books. This can be 500-1,000 loans, each paying $100 to $1,500/mo.

Family Offices and Real Estate Investment Funds with a Lending Division

Family offices and real estate funds have similar capital structures. Most have locked in long-term, low-cost debt against their real estate or with a low-cost bank credit line secured by their real estate and their private loan portfolio. Other real estate funds use partner capital to make hard money loans.

Because of this structure, family offices and real estate investors can do larger bridge loans ($2-25 million) quickly, at lower pricing on lower-leveraged scenarios, topping out at 50-60% LTV.

As mortgage brokers who have closed over 3,000 private money loans, FCTD has the experience, and depth and breadth of lenders, to deliver competitive pricing to our real estate investor clients. Many have had 50+ loans with us over the years. Borrowers wouldn’t keep coming back if they felt they were being overcharged for financing.

Since the funding comes from five different sources (individuals, real estate investors, family offices, conduit lenders, and mortgage funds), FCTD doesn’t have a one-size-fits-all pricing model.

However, because of our track record of 500+ loans per year, plus excellent working relationships, our conduit fix and flip lenders charge lower upfront origination fees on our loans in exchange for consistent deal flow. Even with the lender fee plus broker fee, the pricing would be the same if the borrower went directly to the lender.

For second mortgages, FCTD works with a group of trust deed investors who take on the higher risk of being in second position on title. Their pricing is solid, even considering the greater risk of these loans.

FCTD is very competitive in most pricing situations. If we’re not, we’ll tell you that we’re not a good fit and recommend a few different lenders you should check out.

Our value as mortgage brokers comes from knowing and being known by a lot of people in the private lending industry. We’ve closed many loans and continually talk with borrowers and lenders about what they’re doing and are no longer doing. In a dynamic marketplace, we have our finger on the pulse of the market. Our borrowers benefit from having a strategic partner who can position them to succeed with the right opportunities and lenders.