2 min read

Best Financing Options for a Fix and Flip Project $75,000 Over Budget

This blog post outlines the best financing options for a fix and flip project $75,000 over budget. While obtaining a hard money second mortgage may...

2 min read

This blog post outlines the best financing options for a fix and flip project $75,000 over budget. While obtaining a hard money second mortgage may...

2 min read

Since 2013, First Capital Trust Deeds (FCTD) has originated 700+ hard money fix and flip loans, particularly for properties in California. This blog...

5 min read

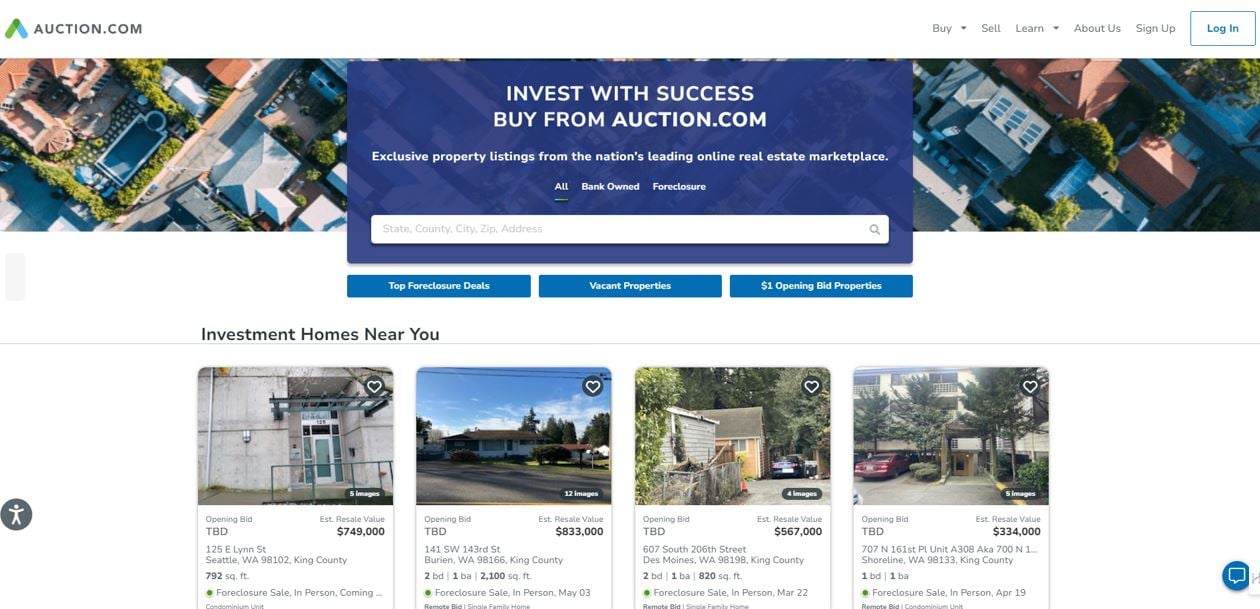

If you’re a real estate investor interested in using fix and flip financing to acquire Auction.com listings, we have all the information you'll need...

7 min read

Real estate investors have their choice of several private money lenders to help them acquire and renovate their next fix and flip project. However,...

3 min read

When searching for fix and flip financing as a house flipper or rehabber, it's not a choice between banks and private money lenders. Essentially,...

2 min read

If you're wondering how the payments on fix and flip plus rehab loans work, you’ve come to the right place. This blog post discusses how private...

%20VS%20Loan-To-Cost%20(LTC).jpg)

2 min read

Fix and flip loans are the primary source for funding a fixer-upper project, and understanding how they work is pivotal to your planning and success....

2 min read

In the fast-moving world of house flipping, understanding fix and flip loans — especially the minimum and maximum loan amounts — is important for...

2 min read

When going into a fix and flip project, it's crucial to understand the distinction between AS-IS value and After Repair Value (ARV) to secure the...

5 min read

If you’re applying for private money financing to renovate a property, you’ll want to prepare all the fix and flip loan application requirements to...