The Elusive 100% LTV Fix and Flip Loan

If you’re cash strapped and in escrow to purchase your next fixer-upper, you might be searching online for a hard money lender to give you the...

If you’re a house flipper already approved for a hard money first mortgage, but need a second mortgage to cover down payment and closing costs, chances are you’re talking about something called gap funding. This blog post will discuss what you need to know about gap funding.

We'll cover the following topics:

But first.....

FCTD does not provide gap funding loans.

It's important for me to state this very clearly, up front. We do not offer gap funding loans to cover down payment and closing costs on fix-and-flip projects. We receive several calls each month from house flippers — already approved for hard money first mortgages — who need First Capital Trust Deeds (FCTD) to provide a hard money second mortgage (aka gap funding) to cover down payments, closing costs and rehab financing. FCTD doesn't do this type of financing. In fact, gap funding is nearly impossible to obtain unless you flip 50-100 homes each year and have a TV show on cable. For most house flippers, who do two to three transactions a year that need gap funding, you're most likely to obtain money from friends and family, or an equity investor in exchange for a percent of the profits.

Now, back to discussing gap funding.

As I mentioned above, gap funding is a hard money second mortgage to cover down payment, closing costs, and sometimes the rehab costs on a fix-and-flip project.

The most common request FCTD sees for gap funding is when a borrower is already approved for a first mortgage at 80-85% loan-to-value (LTV) and needs gap funding for down payment and closing costs.

If you can get a gap funding standalone hard money second mortgage to go behind your high-leverage first mortgage, it’s going to be expensive. Like, very expensive. Be prepared for 20% per year between upfront points and the interest rate:

5 points at 15.00% interest rate = 20.00%

It’s not cheap — nor should it be. The gap funding lender can lose a lot of time and money if your project goes south.

There are two reasons.

Gap funding can be very risky, and expensive for a lender if you default. I explain more in this blog post about second mortgages for down payment and closing costs.

Gap funding became rare when securitization came to the hard money lending industry.

Let me explain.

In 2013 and 2014, there were a few bond and pension funds that bought hard money loans from lenders whose business model was to originate and sell to secondary market buyers. We call them “conduit lenders” — a finance company that originates a loan with the intent to sell. Then in 2015, Wall Street investors entered the market, providing those same conduit lenders with a warehouse line of credit (in industry lingo, a "credit facility”) to fund loans that they would then sell to the Wall Street investor — or into a $500 million or $1 billion securitization to hold the loans until they were paid off. This is known as securitization.

By spreading out the risk across more investors, Wall Street securitization was able to change the game, bringing more capital into hard money lending at a higher leverage (think 80-90% LTV on a fix-and-flip loan.) This is similar to conventional lending, where interest rates for a 30-year mortgage are very low because hundreds of thousands of investors own a share of the mortgage bonds — backed by the full faith and credit of the United States government, which guarantees the mortgage bondholders. Essentially, risk is spread out.

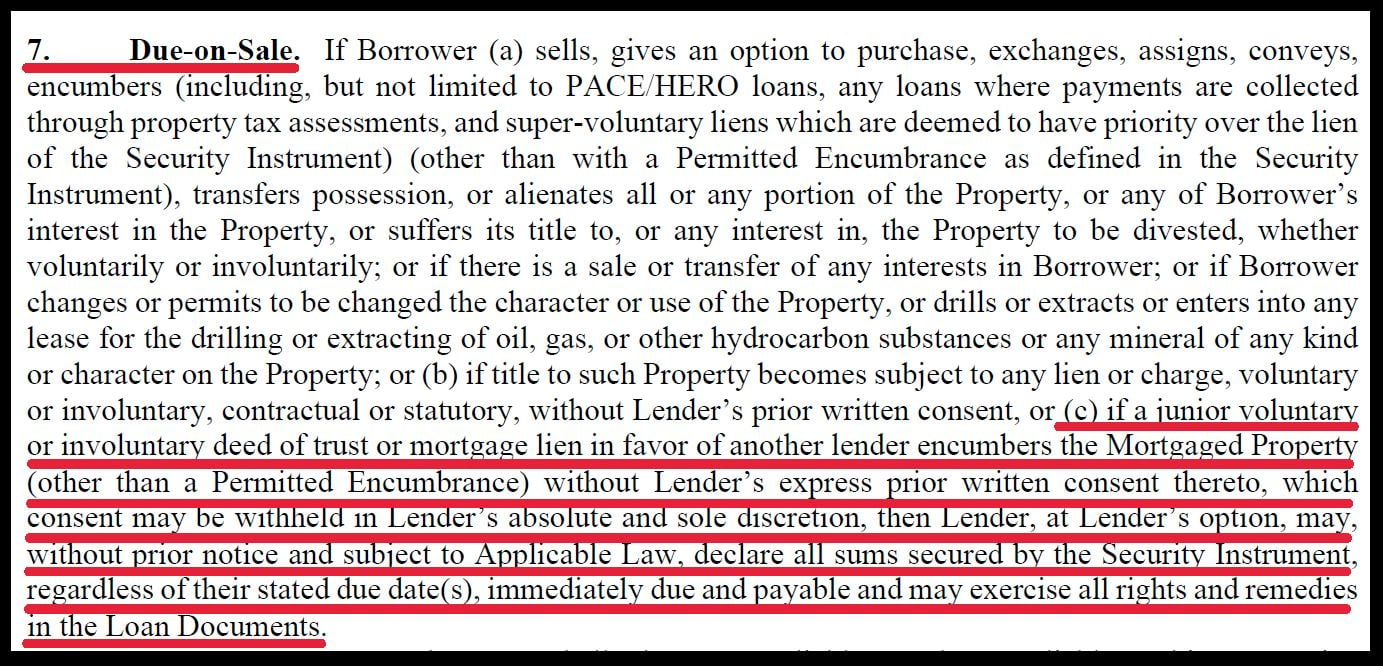

Securitization led to standardized loan documents acceptable to the Wall Street investors, including the promissory note, which almost always has a due-on-sale clause noting that junior liens are prohibited. Below is an example of the due-on-sale clause:

Most hard money fix-and-flip loans over the past eight years were made by the conduit lenders, offering high-leverage, 80-90% LTV on the purchase money loan and 100% of rehab funds through rehab reimbursement. This significantly reduced the demand for gap funding. The borrower only needed to provide a 10-20% down payment, closing costs and part of the rehab funds to flip a house.

House flippers with $75,000 to $100,000 liquidity could obtain a high-leverage loan at an interest rate of 9.00% without turning to a gap funding second mortgage at 15.00% to 20.00%. They could go it alone at a lower cost rather than paying two mortgages' worth of interest and fees.

Gap funding in some form or another still exists in the hard money second mortgage market. However, it isn't found as a standalone second mortgage behind a high-leverage 80-85% LTV first mortgage from a conduit lender.

I've seen a few situations in 2022 where an experienced house flipper asked us about lower-cost debt for their next acquisition. For the past few years, they had borrowed from a local individual with simple loan docs (and a promissory note without language prohibiting junior liens.) The terms were typical of an individual investor making hard money loans:

First Mortgage:

They would also borrow from a gap funder — what they would call an equity investor — for the down payment and closing costs,, and sometimes for the renovation.

Second Mortgage/Gap Funding:

The gap funding second lienholder had invested with the borrower in the past, and was confident that they’d get paid back in full and participate in the upside profits despite the risks of being in second position.

Seller financing in second position shows up every so often. However, it’s rare to see a hard money first mortgage at 80% LTV and seller financing up to 100% CLTV. The first lienholder usually wants a borrower to have “skin in the game” with down payment funds — usually 10-20% of their own money going toward the purchase. It’s rare to find a hard money lender that allows a borrower to have no down payment or seller financing.

It's also rare to find a seller willing to carry a second mortgage at 100% CLTV. I see this in situations where the seller tries to spread out long-term capital gains on the sale of the property. In 2021-2022, when real estate values increased by 25-40% in some markets, I saw a seller carry in second position (and a hard money first lienholder actually allowed it) because the buyer was overpaying for the property by $300,000 to $400,000. For the seller, it was free money over the next five years.

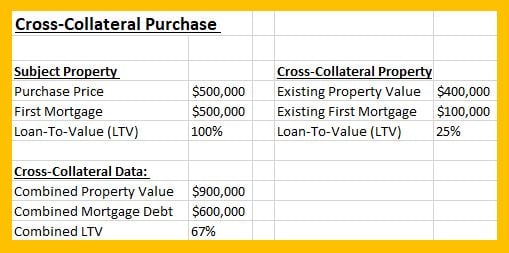

FCTD does several blanket or cross-collateral loans each month for our real estate investor clients. We use the significant equity position of an existing property as additional collateral for the loan, allowing borrowers to come in with very little down payment and closing costs on a new purchase.

There is almost always a first mortgage on the purchase and in second position on the additional collateral, which usually has a low-leverage first mortgage on title.

Below is an example of the financing structure:

If you want to acquire a property with zero down payment, a blanket or cross-collateralized loan structured like the example above is the best way to do it. FCTD has several lenders that will structure a purchase like this, allowing you to keep more capital on hand for your project.

As you can see, obtaining gap funding as a standalone hard money second mortgage on a fix-and-flip project is hard to do. It’s expensive for the borrower, risky for the lender, and usually prohibited by the first mortgage lienholder under the due-on-sale clause in the promissory note. Wall Street’s entrance into hard money fix-and-flip financing with high-leverage purchase and rehab loans made lower-cost capital around 9.00% available to more house flippers — reducing their need for gap funding second mortgages.

If 100% financing on a new fix-and-flip purchase is essential to your project, it’s best to have another investment property with significant equity to use for a cross-collateral loan. This is how FCTD gets it done for our investor clients time and again.

If you’re cash strapped and in escrow to purchase your next fixer-upper, you might be searching online for a hard money lender to give you the...

If you have a seller willing to carry a note, funding your fix and flip with seller financing instead of a hard money loan is a better and cheaper...

If you've always wanted to flip houses and just found a great deal on a fixer-upper that would make a perfect flip, your next step is to find the...