Does a Hard Money Loan Appear On My Credit Report?

Many real estate investors new to hard money loans ask, “Does a hard money loan appear on my credit report?” This question comes up several times...

A hard money loan balloon payment is the total principal balance of the loan plus one monthly payment due in full at the end of the loan term, which is usually 6-24 months from the start of the loan. Balloon payments are a common feature of hard money loans as most are short-term bridge loans with interest-only payments, rather than 30-year amortizing loans like conventional mortgages.

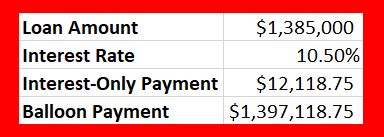

Below is an example of how the balloon payment works:

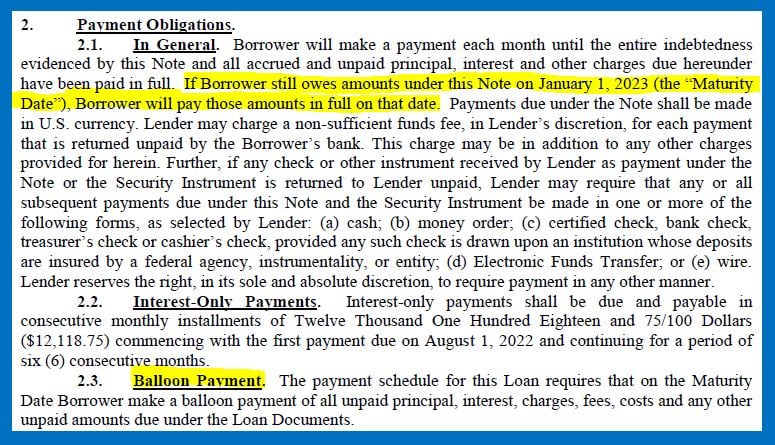

The note will feature information about the maturity date and the balloon payment:

If you can't make the balloon payment at the maturity date, you have the following options:

Loan extensions on hard money loans are often granted to borrowers who have made on-time payments over the course of the loan. When borrowers are consistently delinquent, hard money lenders are less inclined to extend the loan.

Lenders normally charge the borrower an extension fee, which can be paid directly through the loan servicer with the next payment, or added to the back of the loan when the loan is paid off through a refinance or property sale.

By selling the property or refinancing the loan prior to the maturity date, you can avoid paying the balloon payment, the full principal balance of the loan.

If the borrower has skipped monthly payments or can't sell or refinance the property to satisfy the balloon payment, the lender has the legal right to initiate foreclosure by filing a Notice of Default. Foreclosure is usually a last resort after pursuing other ways to satisfy the balloon payment. However, borrowers can avoid foreclosure by making on-time payments and communicating with the lender.

In my experience, borrowers who are frequently delinquent or cut off communications with the lender for long periods of time face foreclosure more than on-time borrowers who stay in contact with their lender. It’s simple, but I see this when borrowers are overwhelmed by multiple projects with costly delays at the same time, like we’ve experienced since the start of COVID.

Conclusion

Balloon payments are written into nearly every hard money bridge loan. The formula is very simple: principal balance + one month payment = balloon payment. At maturity, when the balloon payment comes due, borrowers can either get a loan extension, or sell or refinance the property. If the lender doesn't want to extend the loan, they have the legal right to file a notice of default to initiate foreclosure, which is usually a last resort.

Many real estate investors new to hard money loans ask, “Does a hard money loan appear on my credit report?” This question comes up several times...

This question has come in through the website dozens of times over the years from prospective house-flippers who are short on funds to close their...

Hard money loans for bad credit used to be a thing back in the housing bubble years of 2003-2007. Borrowers with low credit scores (350 to 550) or...