Fix & Flip with Seller Financing

If you have a seller willing to carry a note, funding your fix and flip with seller financing instead of a hard money loan is a better and cheaper...

%20Financing.png)

Over the years, numerous rehabbers and prospective house flippers have asked FCTD for fix and flip after repair value (ARV) financing to fund their next project.

This has always seemed like an odd question because ARV is simply an underwriting data point, just like AS-IS value, loan-to-value (LTV), and loan-to-cost (LTC). They’re simply values and percentages that private lenders analyze when making a credit decision on a fix and flip loan.

What I’ve discovered through these conversations is that people asking for an "ARV loan” are really asking for 100% financing or a zero-down fix and flip loan based on the lender’s estimate of after repair value. They found a great fixer upper but are low on cash, so they're looking for the elusive 100% fix and flip loan while dressing their request up as an ARV loan.

In the remainder of this article, I’ll explain this common misconception so that rehabbers and house flippers can be better informed and adjust their fix and flip financing expectations.

ARV refers to the estimated value of a property after repairs, renovations, or improvements. It's an essential figure in fix and flip financing, especially when the lender is providing both purchase and rehab financing to the investor.

Private lenders determine ARV by ordering an appraisal that provides both the AS-IS value and the after repair value.

Here are the steps in the process:

In addition to using AS-IS value and ARV, private lenders analyze the following factors when setting loan terms, including loan amount, interest rate, and origination fees:

After reviewing all the data, the credit decision may come back with the following figures:

With these numbers, the lender is providing what we call an “80/100” fix and flip loan (80% LTV on the purchase and 100% LTC on the rehab financing).

The $420,000 total loan amount divided by the $600,000 ARV gives us a 70% ARV loan.

This is important:

Fix and flip brokers and lenders may have a page on their website that indicates 75% ARV loans — or even 80% ARV loans. This is somewhat misleading.

It should read, “75% ARV loans or 80/100 purchase/rehab loan, the lower of the two.” The private lender will almost always revert to the lower figure.

As I mentioned in the beginning, most of the house flippers and rehabbers who ask about our “ARV loan program” are really hinting at 100% fix and flip financing if the ARV comes out to 70% or 75%.

That’s wishful thinking.

ARV needs to be kept in context. It's simply one component of the financing equation that private lenders use when underwriting fix and flip loans. It’s not a magical percentage that will lead to a zero down payment loan, where the lender shoulders all the downside financial risk, and the borrower enjoys the upside gains.

I would think of ARV as your (and the lender’s) future protective equity when you sell the house.

In the example above, where the final loan amount came in at $420,000 against a $600,000 ARV, you’ll have an expected $180,000 of net profits (minus real estate agent fees and closing costs).

Summary

After repair value is simply a data point private lenders use when underwriting fix and flip loans for rehabbers and investors. ARV gives lenders an idea of the future protective equity their loan will have after the project is finished and listed for sale.

Many undercapitalized house flippers look to "ARV loans” as a magical solution to acquiring and renovating a fixer upper without contributing any of their own cash to the project.

Instead of looking for an ARV loan, house flippers and rehabbers should look at ARV as the future profit margin when they sell the house — not as an easy way to get into a fixer upper property.

If you have a seller willing to carry a note, funding your fix and flip with seller financing instead of a hard money loan is a better and cheaper...

Over the past 10 years, high-leverage fix and flip investor rehab loans have become a popular private money and hard money loan program for house...

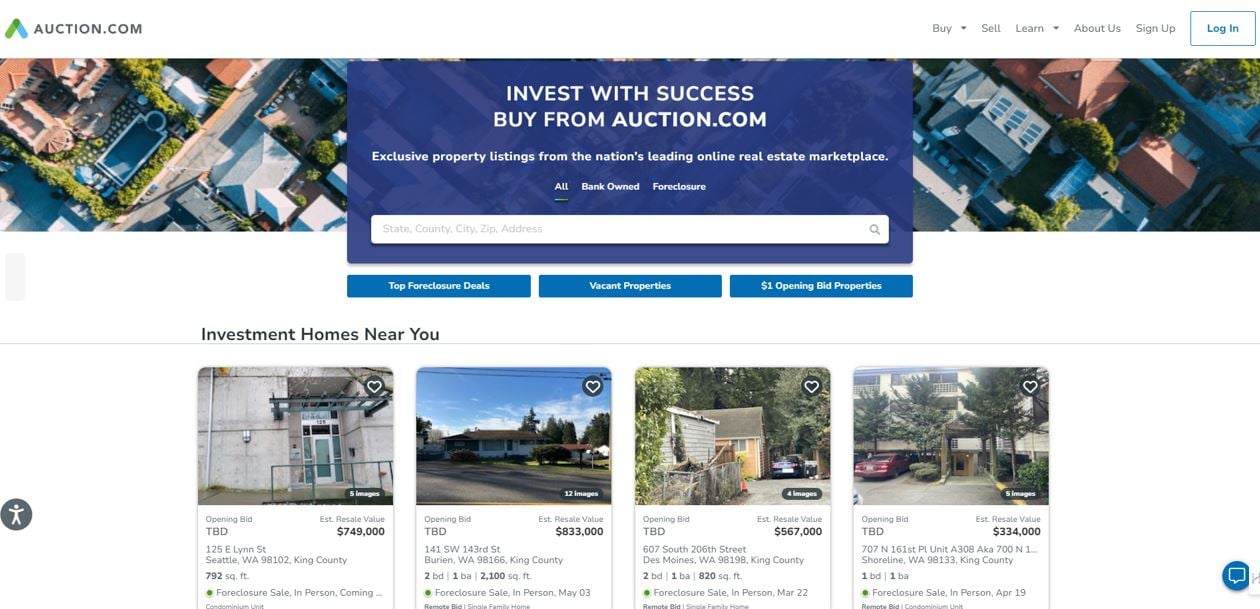

If you’re a real estate investor interested in using fix and flip financing to acquire Auction.com listings, we have all the information you'll need...