The Elusive 100% LTV Fix and Flip Loan

If you’re cash strapped and in escrow to purchase your next fixer-upper, you might be searching online for a hard money lender to give you the...

A few years ago, an experienced house flipper was referred to FCTD for high-leverage fix and flip financing on their upcoming project. This rehabber had always borrowed from a local individual hard money lender, who would use a title company to draft a simple set of loan docs to sign and then fund the loan.

It was an easy arrangement for both the rehabber and the hard money lender. But for this project, the local lender had all their money out on other loans. That’s when FCTD came into the picture.

We secured 85% loan-to-value (LTV) on the purchase with 100% loan-to-cost (LTC) on the rehab financing, with two origination points at 8.99% on a 12-month loan.

Four days before the scheduled closing of escrow (COE), the borrower mentioned that they had a partner on the project.

No problem.

We had the partner fill out the application to run credit and background checks. They also submitted their previous year’s tax returns and three most recent bank statements — all standard underwriting items. Everything checked out.

Two days before the COE, the escrow officer called, asking who this person was who just wired $200,000 into title for this deal.

I had no idea.

I called the borrower who said it was their equity partner, who would be funding the down payment and closing costs. The equity partner had partnered with them on previous deals. And they’d be recording a second mortgage on title to protect their interest in the project, like they had done on deals that their regular lender had funded.

Well, this was interesting.

Our borrowers were used to working with their local hard money lender while FCTD has a decade of working with conduit lenders that originate loans and sell to secondary market investors, as we did in this case.

It’s simply two different ways of doing fix and flip lending.

The rest of this article will cover what you need to know about fix and flip financing with an equity partner when using a conduit lender — which are the most popular source of fix and flip loans.

An equity partner puts up the cash for the deal — either all or some of the funds to cover the down payment and closing costs. They can also fund all or part of the renovation costs.

Equity partner contributions depend on the capital needs of the house flipper and the partnership arrangement.

Most equity partners are the rehabber's friends or family members. They have cash but maybe not the hands-on construction or project management experience of an expert house flipper. Therefore, they invest in projects with their friend in exchange for a fixed return on their money plus profits — or a predetermined percentage of profits.

One could say that the equity partner provides “gap financing” or “gap funding” to cover the house flipper or rehabber's cash shortfall.

The difference between gap funding and an equity partner is that gap funding loans are debt while equity partner contributions provide an equity stake in the profits of a successful fix and flip project.

(We’ve written extensively about gap funding and how most cash-strapped house flippers should really be looking for an equity partner rather than a debt lender to cover their down payment and closing cost shortfall. Please read those articles to get up to speed on why gap funding is so rare.)

A conduit fix and flip lender is a private mortgage lender that originates high-leverage fix and flip plus rehab loans, then sells the funded loans to investors in secondary markets such as pension funds, bond funds, or to other investment managers.

It’s referred to as a "conduit" because these lenders are simply a pass-through from borrower to eventual loan investor.

Private money conduit lenders copied the model residential mortgage lenders have utilized since the 1940s by originating loans and immediately selling to Fannie Mae and Freddie Mac, providing lenders with fresh capital to make new loans.

This is the same thing — just for private money loans.

Conduit fix and flip loans offer rehabbers 80-90% LTV financing on the purchase plus 100% LTC rehab financing.

These high-leverage fix and flip loans allow house flippers to retain more cash on hand, which can be used for:

This lending model has significantly benefited rehabbers over the past 10-15 years, freeing billions of dollars of additional capital that wouldn’t have been available with the previous model, where local individuals conservatively lent money at 65% LTV.

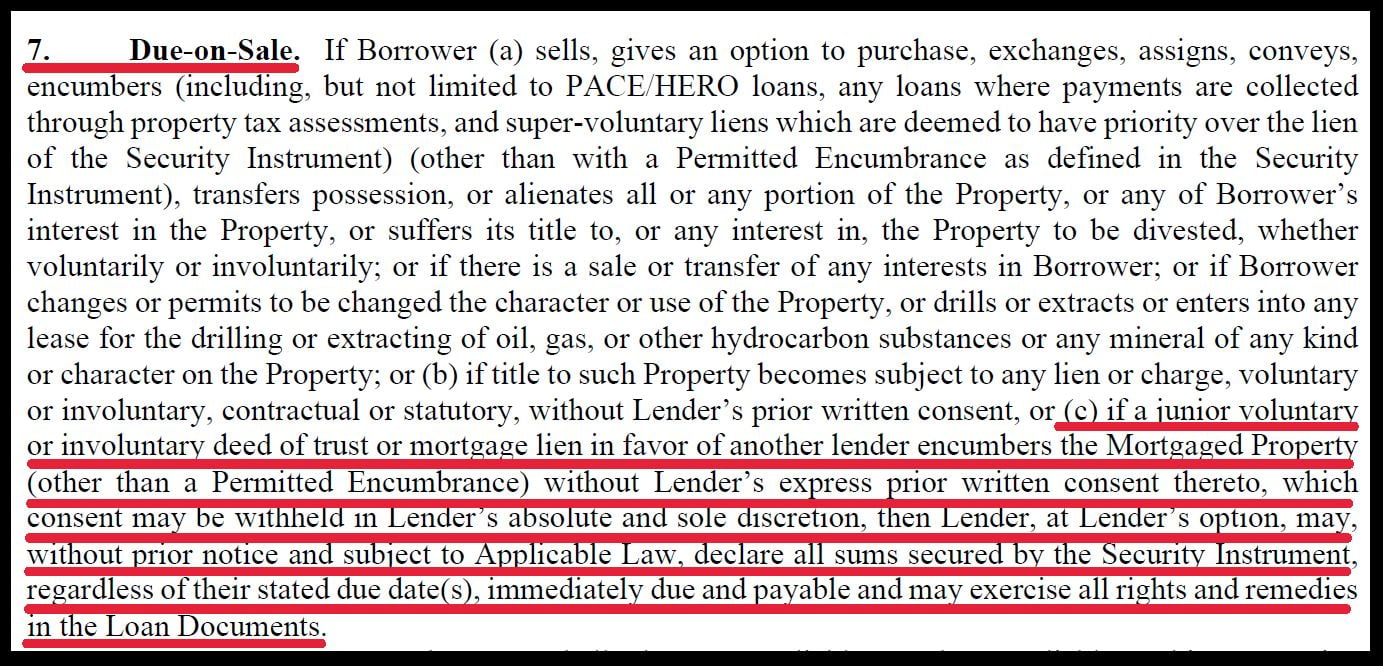

Most conduit fix and flip lenders have language in their promissory note prohibiting voluntary junior liens, which reads something like this:

This was the exact language FCTD encountered in the promissory note with the investor and their last-minute equity partner from the example at the beginning.

Conduit lenders and their secondary market investors often require this language in the note to protect from margin erosion, which cuts into the protective equity between the loan balance and AS-IS value of the property.

If the equity partner records a second mortgage on title, the first position fix and flip lender loses their protective cushion in the property.

An example of margin erosion is when a fix and flip project is delayed, sits idle, and continues to accrue debt that needs to be paid. This cuts into the rehabber’s profit margin and the lender’s protective equity or margin. Therefore, conduit lenders and their secondary market investors prohibit junior liens from being recorded.

Below are the steps to follow if you are obtaining high-leverage fix and flip financing with an equity partner through a conduit lender.

First, agree on how the partnership will work.

... And much more. There are so many variables that can arise in a fix and flip project, stemming from the condition of the property to the scope of work for the project.

Inform your lender (or broker) that you have an equity partner and submit a limited application to verify the following information:

Credit Report

Background Check

Source of Funds

(Typically, 3-6 bank statements will do it. Conduit lenders adhere to anti-money laundering laws and will ask the equity partner to source all large deposits)

If you’re like our rehabbers at the beginning, whose equity partner had always recorded a second mortgage on title, you’ll want to ask the lender if the language in their loan docs allows for or prohibits a voluntary junior lien to be recorded on title.

Some lenders, like some mortgage funds and private individuals, don’t have language in their loan docs prohibiting a junior lien. If that’s the case, feel free to record a junior lien if that’s the typical arrangement with your equity partner.

If the lender prohibits junior liens, but the equity partner wants their interest to be protected somehow, you’ll want to ask the lender for their recommendation to satisfy both their requirements and those of the equity partner.

In our situation above, the conduit lender recommended the following changes:

These two changes satisfied the lender and borrower/equity partner requirements. It allowed them to close escrow on time and immediately start the cosmetic rehab project, which resold in four months.

If you flip homes using fix and flip financing, and have an equity partner who provides funds for down payment and closing costs, you’ll want to make sure you inform the lender about the equity partner arrangement.

Conduit fix and flip lenders usually won't allow the equity partner to record a junior lien, whereas some mortgage funds and private individuals will.

If your lender doesn’t allow the equity partner to record a second mortgage, ask the lender to recommend the best way to structure your agreement with the equity partner to satisfy the conduit lender’s requirements. Most conduit lenders have experienced this situation before and have ideas to best structure the agreement to protect all parties' financial interests.

If you’re cash strapped and in escrow to purchase your next fixer-upper, you might be searching online for a hard money lender to give you the...

Real estate investors have their choice of several private money lenders to help them acquire and renovate their next fix and flip project. However,...

If you’re a house flipper already approved for a hard money first mortgage, but need a second mortgage to cover down payment and closing costs,...