Foreign National Hard Money Bridge Loans

Foreign national hard money bridge loans are short-term mortgages available to non-U.S. citizens to purchase or refinance real estate in the United...

3 min read

Ted Spradlin

:

Jul 6, 2023 11:17:46 AM

Ted Spradlin

:

Jul 6, 2023 11:17:46 AM

When it comes to acquiring or renovating hospitality properties, investors often turn to an alternative financing option known as cross-collateralized hard money bridge loans. These specialized loans offer a unique solution for borrowers who need quick and flexible financing for their hospitality real estate holdings.

A bridge loan is a short-term loan that serves as interim financing for a real estate transaction, often when traditional sources of funding are unavailable or take too long to close. Bridge loans provide borrowers fast access to capital for time-sensitive projects, such as acquiring distressed or vacant properties, completing renovations, or bridging until long-term financing becomes possible.

Cross-collateralization is an essential concept in private lending that involves using multiple assets as collateral for securing a loan. Rather than relying on a single property's value, cross-collateralization allows borrowers to leverage the combined equity from various real estate assets they already own. In other words, instead of putting up one property as collateral, multiple properties are put up collectively to secure the loan amount.

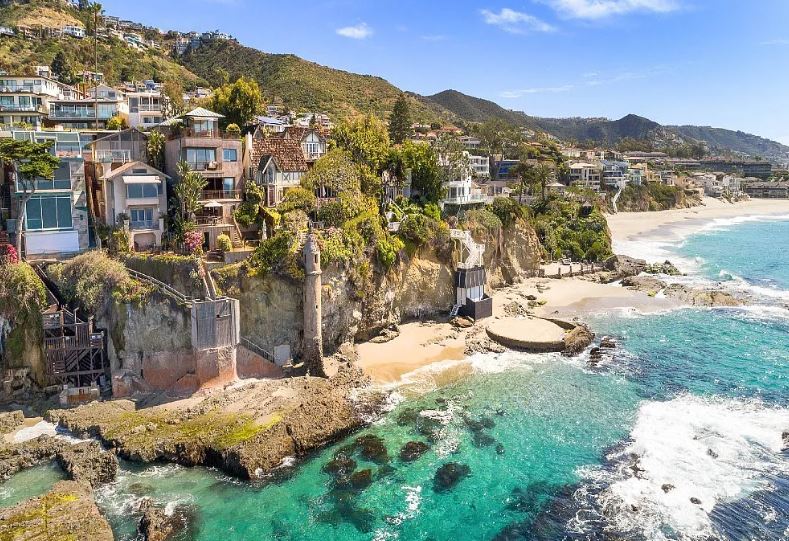

Hospitality properties encompass hotels, resorts, motels and other accommodations designed for short-term stays. Investors in the hospitality industry face specific challenges related to market fluctuations — from recessions and booms, to seasonality factors and ongoing maintenance costs.

Hard money lenders with experience financing hospitality properties will offer cross-collateralized bridge loans when the conditions and borrower circumstances make sense.

In hospitality property financing, hard money loans can be a useful alternative to traditional bank loans. Hard money loans are short-term, asset-based loans offered by private lenders or investors, commonly called hard money lenders.

Unlike conventional bank financing, which relies heavily on credit and financial performance data, hard money loans are determined by the value and potential of the underlying collateral. These loans are typically secured by the hospitality property itself and involve higher interest rates than conventional loans due to their riskier nature.

Owner-operators and investors can use multiple hospitality properties and other investment real estate for cross-collateral hard money bridge loans.

Over the past decade, FCTD has worked with owners to finance the following loan scenarios:

Acquiring a new property

Purchase a property with equity from an existing property (or properties) using a cross-collateral blanket loan.

When a hotel operator switches brands, it can trigger a multi-million dollar renovation to meet the requirements of the new brand. Cross-collateralized bridge loans use the equity from a fully operational property to free up funds for the renovation.

Many hotel owners secured ultra-low interest rates from 2020-2022, and will elect to keep the first mortgage in place, while taking on more expensive hard money second lien debt to invest in or acquire a property.

When it comes to hospitality properties, cross-collateralized hard money bridge loans can offer several advantages over traditional financing options. First, these loans provide investors quicker access to funds, allowing them to take advantage of investment opportunities with a shorter timeline to act. Moreover, bridge loans offer flexible repayment terms, from 3-36 months, suited to specific borrower and transactional circumstances.

This ensures that investors have necessary financing during transitional phases of acquiring or renovating hospitality properties. Additionally, with multiple assets as collateral, borrowers can secure larger loans and potentially more favorable terms.

Another advantage is that hard money lenders may be more willing to overlook previous one-time credit blemishes, or instances when cash flow is low due to a property overhaul. These situations could disqualify borrowers from obtaining conventional financing.

The flip side to the faster turnaround and more flexible lending criteria is higher interest rates, shorter repayment terms, and potential interest guarantees or yield maintenance requirements.

Also, it can be difficult to accurately value the multiple properties used as collateral, including their fair market value, location, condition, and future potential value.

Borrowers must also carefully assess their ability to meet repayment obligations within the agreed-upon time frame, given the short-term nature of bridge loans.

Cross-collateralized hard money bridge loans offer a valuable financing solution that empowers hospitality property investors with quick access to capital during transitional periods. With benefits like expedited funding and flexible terms, these loans can give investors the opportunity to move quickly on new investment opportunities, or to finance the renovation of an existing property.

Foreign national hard money bridge loans are short-term mortgages available to non-U.S. citizens to purchase or refinance real estate in the United...

Hard money second mortgages for hotels can help hospitality property owners quickly access equity from their lower interest, long term debt secured...

If you're a real estate investor or entrepreneur in California, a hard money business purpose HELOC (home equity line of credit) gives you quick...