Hard Money Loans: Business Purpose Versus Consumer Purpose

If you’re online searching for a hard money loan to solve your particular financial problem, it’s important to know if your financing scenario is for...

5 min read

Ted Spradlin

:

Jul 9, 2023 9:23:14 AM

Ted Spradlin

:

Jul 9, 2023 9:23:14 AM

If you’re seeking private financing for a residential or commercial parcel of land, you’ve come to the right place. This article will cover an important but often misunderstood topic: the difference between business purpose and consumer purpose vacant lot hard money loans. Many prospective borrowers, especially those looking for hard money financing to purchase a lot for their dream home, are unaware of the distinction between business and consumer lending.

Below, I’ll cover the most important details that you need to know, giving you a better idea of how hard money lending works and how you may — or may not — be able to use a hard money loan to finance a vacant lot. The hope is to save you time and energy in your search for vacant lot financing.

Coming out of the Great Financial Crisis (GFC) of 2007-2008, new laws were passed that impacted mortgage lending as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act. Most Dodd-Frank mortgage lending laws were aimed at curbing the abuses in conventional lending for consumers' primary residences.

Dodd-Frank also impacted hard money and private money lending by establishing business purpose and consumer purpose standards that private lenders need to comply with when underwriting loans. Lenders need to document if the funds will be used for business or consumer purposes (more on that below). Compliance for business purpose lending is relatively simple — but more complex for consumer purpose lending. Lenders can face significant penalties if the law isn't followed exactly.

With the new regulations, nearly all hard money lenders discontinued providing consumer purpose loans and shifted to focus 100% on business purpose loans.

A business purpose loan is for a bonafide business purpose like purchasing an investment property, a home builder financing the construction of a spec home, or a hard money cash-out refinance where the loan proceeds go directly into a business bank account used solely for business. For example, FCTD once did a hard money second mortgage for a caterer who moved into a new location and purchased $350,000 in commercial kitchen equipment. That’s certainly a business purpose.

A consumer purpose loan, on the other hand, is a loan for personal use, like a mortgage against a primary residence or second home. Or, for a person who refinanced a residential rental property (assumed to be for business purposes), but used the cash-out proceeds to pay off an IRS lien for personal income taxes. Even though it’s an investment property, the funds were used for consumer purposes — personal income taxes. (It would be business purpose if the tax lien was for business income taxes, however.)

If you want to dive deeper, check out this article, Hard Money Loans: Business Purpose Versus Consumer Purpose.

Most hard money lenders focus on working with real estate investors, builders, developers and entrepreneurs who provide business purpose loans. When an investor comes to FCTD to finance a vacant lot, that’s a business purpose loan and something that our group of lenders and trust deed investors would be interested in funding.

Below are two examples of business purpose vacant lot hard money loans that FCTD originated in the past few years.

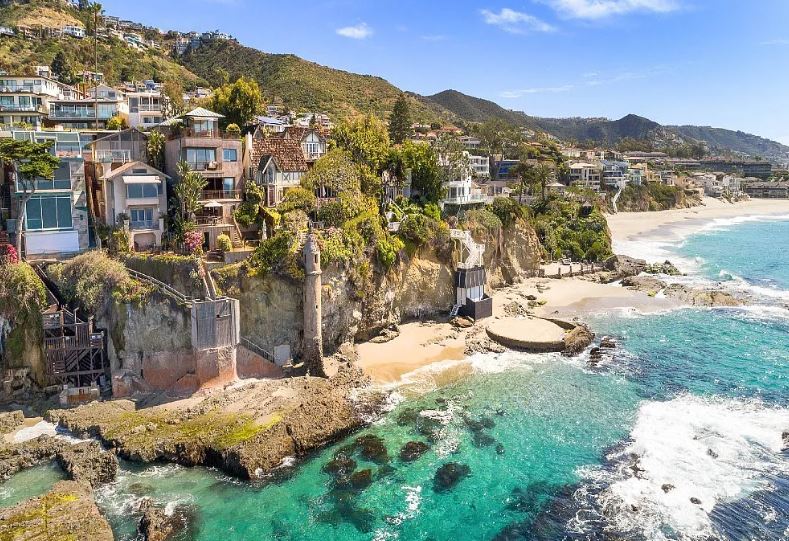

A real estate investor in Central Oregon acquired an un-entitled 10-acre parcel on Bend’s westside for $725,000. They completed the entitlements to build a single family residence on the lot and resold the property for $1,050,000 a year later. This loan was for business purposes.

A hospitality investor acquired two entitled parcels to build a 250-room hotel using a 12-month hard money loan for the vacant land. This loan clearly is for business purposes.

FCTD receives several calls each year from consumers seeking hard money financing to buy a lot to build their dream house, or to purchase several acres to place a manufactured home as their future primary residence. Both uses are for consumer purposes. FCTD can't do these loans because we don't work with any hard money lenders or trust deed investors who finance consumer purpose land loans.

If you need financing to buy a vacant lot to build your dream home, check with the following sources for consumer purpose vacant lot financing.

Will the seller finance your vacant lot purchase? Sometimes, sellers will carry a loan on the property and when you apply for a construction loan, may even subordinate into second position behind the new construction loan.

If you’re in contract to purchase a vacant lot, it's a good idea to inquire with your bank or credit union about financing the lot purchase as part of the construction loan.

For example, you’re in contract to buy a residential lot for $500,000, with planned construction costs of $800,000. Your bank may finance 50% of the lot purchase price and 100% of the construction costs (minus soft costs — plans, permits, architect, etc.) You could extend your purchase contract 90 days to work on architectural plans, budget and permits. This might allow you to obtain a $1,050,000 loan ($250,000 lot + $800,000 construction). The bank will release $250,000 to finance the lot and hold back $800,000 in stage funding payments, which only charges you interest on deployed funds.

To be honest, finding a hard money lender to actually finance a vacant lot for consumer purposes is like finding a needle in a haystack. There are a handful of lenders in California that may consider it. And I mean a small handful — maybe 4 or 5 lenders that may do the loan.

I don’t know of any lenders that will do a consumer purpose vacant lot loan in any of the other states in which FCTD originates loans. None in Oregon, Washington, Utah, Idaho, Montana, Arizona, Florida, Colorado, Hawaii, etc.

Conclusion

If you’re seeking financing for land, you need to know the differences between business purpose and consumer purpose vacant lot hard money loans. Hard money lenders focus their efforts on business purpose vacant lot loans used by real estate investors, developers, or entrepreneurs. But if you're building your dream house or buying land to place a manufactured home as a primary residence, it will be next to impossible to secure a hard money loan. If consumer purpose financing is the category you fall into, it's best to seek financing elsewhere — either from the seller or a bank or credit union — to get the loan you need for your future primary residence.

If you’re online searching for a hard money loan to solve your particular financial problem, it’s important to know if your financing scenario is for...

If you're a real estate investor or entrepreneur in California, a hard money business purpose HELOC (home equity line of credit) gives you quick...

A business purpose hard money second mortgage is a type of loan issued by nonbank private lenders, including individual trust deed investors, family...