What are the Yields on Trust Deed Investments? 2024

If you’re researching trust deed investments or looking to fund or buy existing Notes from new mortgage brokers, you’ll want to know if the rate of...

First Capital Trust Deeds (FCTD) originates loans with trust deed investors in a few different ways. Most private money loans are funded by a single trust deed investor for the entire loan amount. However, another way to fund trust deed investments is with multi-lender loans, or fractional loans, where two or more investors, or private beneficiaries, fund the loan.

This blog post will cover the three different ways FCTD originates and sells multi-lender loans with trust deed investors, including:

When FCTD originates a multi-lender loan for either a purchase or refinance, the trust deed investors on the loan are usually friends and family going in on the loan together. It’s common to see the two to three beneficiaries of the loan share the same last name, where one person is managing various entities for the family members, including trusts, self-directed retirement accounts, or a limited liability company.

I also see the same group of two to three friends funding several loans together throughout the year.

As the broker of record for FCTD, I review every one of the 500+ loans we close each year, so I know the private beneficiaries on the multi-lender loans. It’s not uncommon to see a partner in FCTD funding a portion of the loan alongside the private beneficiaries.

On occasion, we'll pair investors who don't know each other together on a loan. However, this only happens two to three times per year. When it does happen, we’ll have a 5-10 minute conference call with the investors in the loan to discuss terms and conditions, including an intercreditor agreement, close of escrow, and loan servicing arrangements.

FCTD has recently started selling funded notes to trust deed investors, either a single note buyer or multiple investors. If you’re an experienced trust deed investor, or have researched trust deed investments online, you’ve probably come upon numerous note buying or note sale websites. I get calls every so often from a few of these websites asking if we have notes yielding 12-14% that we could sell them.

The notes FCTD have sold were funded by an FCTD partner to a long-time trust deed investor who wanted to fund the loan at origination, but hadn’t received a payoff in time. Thus, the FCTD partner funded the loan to close escrow, then sold the loan to the trust deed investor when their funds became available.

FCTD has invested in software that makes selling notes much easier for trust deed investors. I expect that in the years to come, selling notes will become a larger part of our business as it will allow us to close the loan quickly for the borrower, then sell the whole or fractionalized loan to multiple trust deed investors within a few weeks of close of escrow.

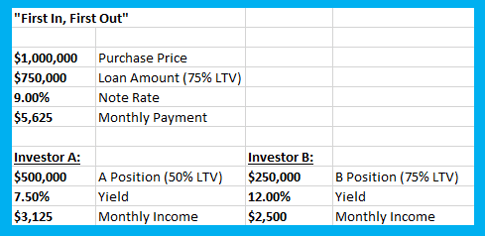

Over the past few years, we’ve experimented with a “First In, First Out” method on a couple of private money loans. “First In, First Out” means that there are two investors on a loan, A and B, with the A investor taking the lowest leverage and receiving a lower yield, while the B investor takes the highest leverage position and receives a higher yield.

Investor A, the “First In” investor, is the first to get the borrower's monthly payments from the loan servicer. If the borrower defaults on the payment, Investor A can ask Investor B to pay off his portion of the loan, or “First Out” clause.

FCTD has numerous trust deed investors with different investment goals and risk appetites. This system allows investors options that fit their preferences. For example, Investor A likes low leverage and lower yields in the 6.50% to 8.50% range. He wants steady monthly payments and to minimize the possibility of future headaches (defaults).

Investor B is comfortable with higher leverage because he wants a 12.00% return on his money. In the event of default, he has significant liquidity to buy out Investor A’s $500,000 portion. He also is comfortable navigating a loan default as he understands the process and works with the attorneys, loan servicer, trustee and borrower.

With the first-in, first-out multi-lender loan, investors have a conference call prior to funding the loan to discuss the intercreditor agreement, loan servicing, and securities exemption filing. FCTD handles all the paperwork and filings. The investors just need to do their loan due diligence: review the title, borrower profile, property, exit strategy, etc.

Conclusion

Trust deed investment through multi-lender or fractionalized loans can work well as an investment strategy. Investors who manage family funds can allocate funds from various entities into the same private note. Those who want lower risk and lower return can be paired with an investor seeking a higher yield with a higher risk tolerance.

If you’re researching trust deed investments or looking to fund or buy existing Notes from new mortgage brokers, you’ll want to know if the rate of...

If you’re an investor and want to get a good idea of the types of loans that FCTD originates with private beneficiaries like yourself, this Best of...

A little while back, I had a conversation with a friend rolling $250,000 from their 401K into an IRA after leaving the company they’d worked at for...