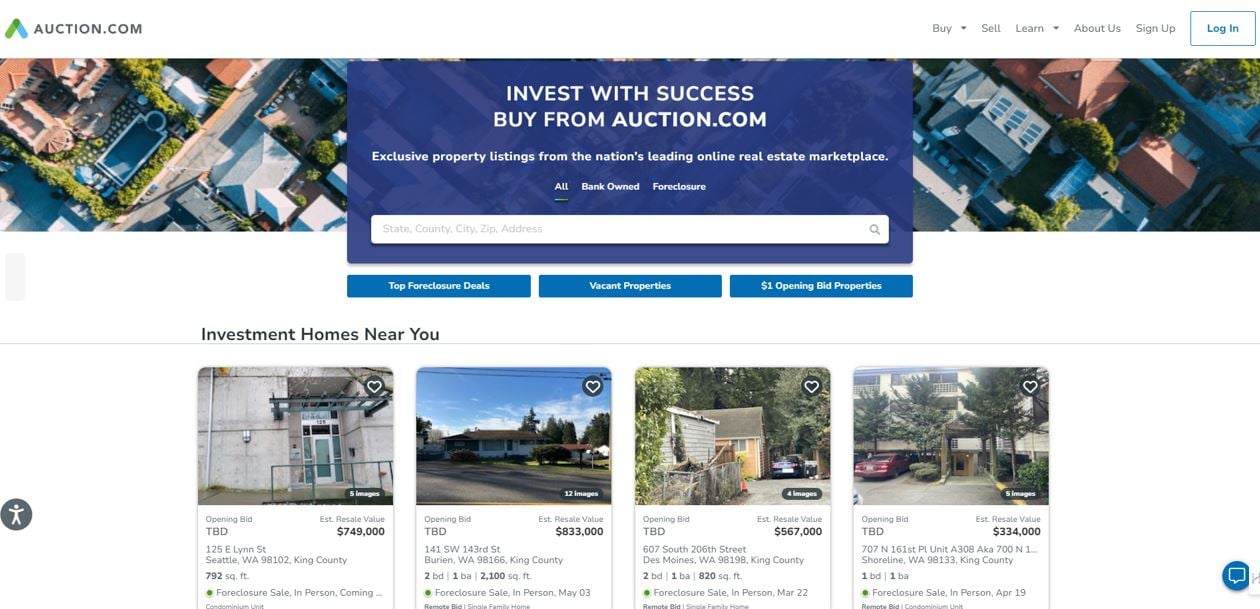

Fix and Flip Financing to Acquire Auction.com Listings

If you’re a real estate investor interested in using fix and flip financing to acquire Auction.com listings, we have all the information you'll need...

3 min read

Ted Spradlin

:

Dec 27, 2022 8:03:26 AM

Ted Spradlin

:

Dec 27, 2022 8:03:26 AM

During the real estate downturn of 2008-2012, many investors flocked to foreclosed commercial property auctions on the county courthouse steps. They could acquire properties that were deeply discounted from their 2005-2007 prices. Many of these same investors, along with new participants, are now gearing up again for an increase in distressed properties —and have reached out to FCTD to secure the hard money financing to do so.

Recently, an investor requested funds to purchase a commercial building at a Trustee Sale for $8 million dollars. The investor valued the property at $16 million and wanted FCTD to line up funds for the entire $8 million dollar discounted purchase.

The 50% Loan-To-Value (LTV) on a $16 million dollar building sounds attractive, but there’s more to the story from the underwriting and lending side.

Let’s take a look…

The down payment is the first item to check off. If the borrower is coming in with a 25-35% down payment on an $8 million auction purchase price, then we might have something. If they’re seeking 100% hard money financing —with the logic that they found a great deal and the equity is built into the purchase price — then we’re probably dead in the water.

Even if the deal is great, like this one could be, nearly all hard money lenders require a borrower to come in with down payment funds. Borrowers need to have some of their own money at risk. Without borrower skin in the game, the lender absorbs all the risk and downside if something goes wrong, while the borrower gets the upside using 100% of other people’s money.

We’d want to see proof of funds, for at least $2-3 million in this case, to move onto the next step.

We’d need to do a deep-dive on this property to ensure there isn’t something terribly wrong. We'd consult commercial brokers in the area, especially those with the current or previous listing, to find out everything there is to know about the building. These local experts can play a vital role in determining if the property is a good investment.

Is there an existing scope of work floating around that a prospective buyer would need to review prior to purchasing? Sometimes, owners will walk away from a property with environmental contamination and a multimillion-dollar remediation price tag.

In addition to the property, we would conduct due diligence on the prospective buyer. Who is the sponsor? Do they have experience owning this type of commercial building? What’s their background? Do they pay their bills on time?

If everything about the property and borrower checks out, then we’ll start looking at what happens after acquisition.

There are many questions we ask about each component leading up to the eventual exit strategy. Does the investor have a business plan for the property after winning the auction bid? Who is the targeted tenant (office, industrial, hospitality, etc.)? Is the market strong or soft for this property type? Does the sponsor have a real estate agent lined up to start marketing the property? How long is the marketing time?

After acquisition, how long will it take to go in and renovate? Will specialists, like architects and engineers, be needed? What is their work availability (factoring in labor shortages)?

What permits, if any, are required? How long are the city and county taking to approve permits? (Some are fast while others are terribly slow). What’s the cost of renovations?

The above items often come at a hefty cost. In addition to the $2-3 million down payment, we’d want to make sure the sponsor has additional liquidity, or partners on the project with funds available to make these improvements.

After we've answered these questions and verified additional liquidity, we’d want to know how the hard money loan will be paid off – the actual exit strategy. What’s the lending market for this type of commercial property? What cap rate are appraisers using? Will a bank or insurance company provide a 5-year loan, and if so, at what point? (FCTD works with experienced commercial brokers to get borrowers into long-term institutional financing.)

If the borrower and property have jumped through all the due diligence hoops, and the business plan positioned for the current market environment, then we’d work with one of our trust deed investors to fund the foreclosure auction purchase. (FCTD is a mortgage broker with investors interested in funding auction purchases where the borrower participates in the purchase, and all the due diligence is complete.)

Most sales at foreclosure auction require funds on the day of the auction. The borrower and lender will need to be at the county courthouse steps with several denominations of cashier’s checks and cash. For an $8 million dollar purchase, that means a lot of cashier’s checks and cash in their pockets, followed by a trip to the bank after winning the auction to get the remainder of the cashier’s checks to secure the property.

Conclusion

It is possible to buy a commercial property at foreclosure auction on the courthouse steps using hard money loans. However, it does require plenty of due diligence from the prospective buyer (sponsor), mortgage broker and trust deed investor (lender). Commercial buildings are a different animal than residential properties, with different risks and market dynamics. While a lot of work, they can be very lucrative for the winning bidder with the knowledge, experience, liquidity and business plan to turn the building into a high-performing investment.

If you’re a real estate investor interested in using fix and flip financing to acquire Auction.com listings, we have all the information you'll need...

A foreign national mortgage loan is a specialized loan product offered by some U.S. lenders to foreign non-residents who wish to purchase U.S. real...

Automotive building hard money bridge loans can be a useful short-term financing option for owner-operators and real estate investors who need fast...