Do You Fund Hard Money Second Mortgages to Cure a Foreclosure on Owner-Occupied First Mortgages?

If you're seeking a hard money second mortgage to cure the foreclosure action on the owner-occupied first mortgage secured by your primary residence,...

1 min read

Ted Spradlin

:

Sep 2, 2023 2:40:37 PM

Ted Spradlin

:

Sep 2, 2023 2:40:37 PM

First Capital Trust Deeds (FCTD) doesn't provide hard money second mortgages for home improvements, if the property being used as collateral is a primary residence or second home.

Home improvement loans usually refer to a loan secured by an owner-occupied residence or second home, which are considered consumer purpose loans. FCTD doesn’t offer consumer purpose home improvement loans.

We recommend that borrowers check with their bank or credit union to get either a 5-10 year home improvement mortgage or an open-ended Home Equity Line of Credit (HELOC), which offers a 10-year draw period followed by a 15-year repayment in years 11-25.

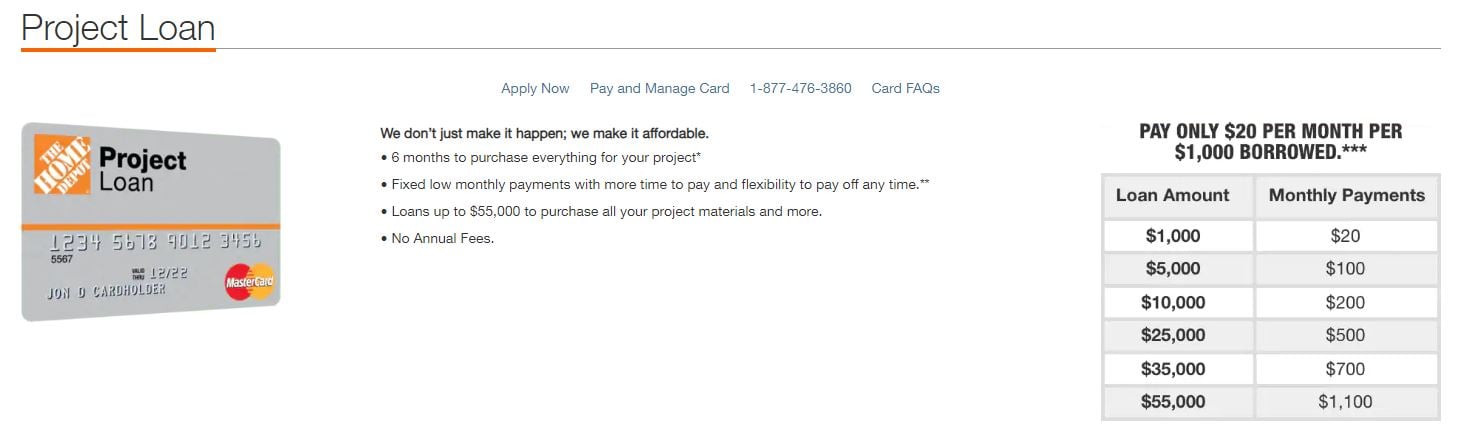

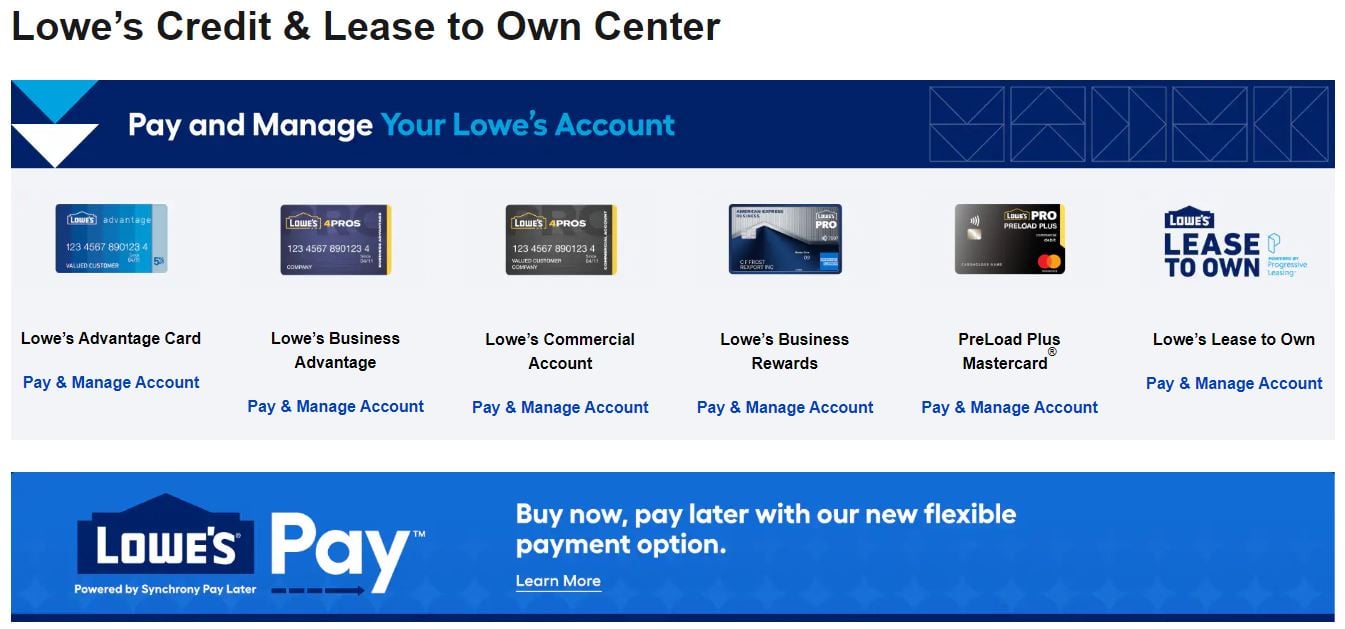

If your bank or credit union won't provide a home improvement loan, consider applying for a credit card with Home Depot or Lowe’s. They offer credit cards and project loans, often with 0% terms during the first 6 months. I financed $7,800 of carpet over 6 months at 0% when I opened a Lowe’s credit card.

If you need a second mortgage for home improvements on your primary residence or second home, it’s best to avoid pursuing a hard money second loan. You’ll be much better served by applying with your bank, credit union, or Home Depot or Lowe’s for a credit card. The terms are much better than a hard money loan.

If you're seeking a hard money second mortgage to cure the foreclosure action on the owner-occupied first mortgage secured by your primary residence,...

FCTD has a minimum loan amount of $150,000 and will not consider a $20,000 hard money second mortgage. Smaller loans are often more time-consuming,...

First Capital Trust Deeds (FCTD) does not offer hard money second mortgages for personal debt consolidation, even to bring up credit scores in order...