Most Hard Money Loans Have a Personal Guaranty

If you’re seeking private financing for your real estate project, be aware that most hard money loans have a document called a Personal Guaranty....

2 min read

Ted Spradlin

:

Oct 9, 2022 9:40:57 AM

Ted Spradlin

:

Oct 9, 2022 9:40:57 AM

If you’re new to hard money lending, it’s important to know that the prepayment penalty can work differently from traditional bank loans or non-qualifying mortgages (non-QM). This blog will contrast traditional prepayment penalties with the two hard money loan prepayment penalties you're most likely to see on bridge and longer-term loans.

Below are the topics I'll cover:

Most conventional loans, like bank loans or non-QM loans, have a prepayment penalty over the first one to five years, calculated at 80% of six months of interest.

For example, on a $500,000 conventional loan at 5% interest only, the monthly payment would be $2,083 per month. With a 36-month prepayment penalty (a payoff within the first 36 months), the borrower would pay a $10,000 penalty.

$2,083/mo x 6 months = $12,500 x 80% = $10,000

If the loan was paid off at month 34, two months before the prepayment penalty expired, the penalty would still be $10,000. Traditional loans don’t prorate the prepayment penalty even if a borrower pays off the loan right before the penalty period expires.

In hard money lending, where most loans are 6-24 month bridge loans, lenders and trust deed investors typically use a guaranteed interest clause rather than a traditional prepayment penalty. A three-month interest guarantee means the lender requires at least three interest-only payments on the loan. Since lenders want at least a few months of yield prior to pay off, they’ll include a guaranteed interest clause.

If a $500,000 hard money bridge loan at 10% interest only ($4,166 per month), with a three-month interest guarantee is paid off after the second payment, they would pay the principal balance plus the third month interest payment.

Payoff after two payments: $500,000 + $4,166.67 (month 3) = $504,166.67

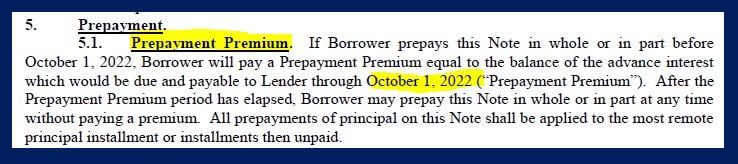

Below is an example of how the prepayment penalty reads in the note:

As you can see from the example above, the prepayment premium, or guaranteed interest period, expires on October 1, 2022.

“After the prepayment premium has elapsed, Borrower may prepay this Note in whole or in part at any time without paying a premium.”

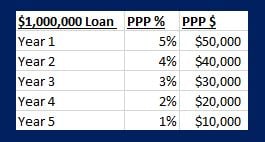

Some hard money loans are written for 5-15 years, which can have sliding scale prepayment penalties for the first two to five years. I’ve originated several 15-year hard money loans with a five-year 5,4,3,2,1 sliding scale prepayment penalty, starting off at 5% of the loan balance in year one and ending with 1% of the loan balance in year five, with no penalties in years 6-15:

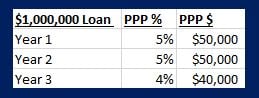

Lenders requiring a sliding scale prepayment penalty can negotiate the terms any which way. If a borrower takes out a 15-year loan but expects to pay off the loan within three years, the lender may set different terms, such as 5% of the loan balance in years one and two and 4% in year three:

Conclusion

Hard money prepayment penalties are different from bank and conventional loans, which are usually 80% of six months interest for a certain period. Short-term hard money bridge loans often have a guaranteed interest clause requiring three payments as a prepayment premium, after which the balance can be paid in full without penalty. You're most likely to see sliding scale prepayment penalties for longer term, 5-15 year investment property hard money loans.

If you’re seeking private financing for your real estate project, be aware that most hard money loans have a document called a Personal Guaranty....

If you’re new to hard money lending, you’re probably not aware of the many different types of hard money loans real estate investors regularly use to...

When real estate investors come to me for a hard money loan, they may or may not need to have a formal appraisal of their property. Appraisals in...